How I Made $2 Million In The Stock Market is a book written by a dancer, Nicolas Darvas about his journey to becoming profitable in the stock market. Even though the book was written a long time ago (1950s), it’s remarkable how we (traders) can still relate to what he went through. In the following paragraphs I will be quoting from the book.

At some point he had researched, tested and found a strategy based solely on fundamental analysis which he believed to be his ticket to riches. The following quote is when he discovered a stock named JONES & LAUGHLIN which met the criteria according to the strategy:

“A tremendous enthusiasm came over me. This undoubtedly was the golden key. I felt fortune within my grasp like a ripe apple. This was the stock to make me wealthy. This was a gilt – edge scientific certainty, a newer and greater BIRLUND. It was sure to jump 20 to 30 points any moment.”

BIRLUND was a stock he received by happenstance, made him money and got him interested in the stock market.

It follows that he was so sure of the strategy and the stock (JONES & LAUGHLIN) that he was willing to buy a large amount of it. To do this he mortgaged a property, loaned against a policy and asked for an advance on one of his work contracts. In the book he writes why he did it:

“I did not hesitate for a moment. I had no doubts. According to my most scientific and careful researches, nothing could go wrong.”

So he went on to buy a large amount of shares on margin (money borrowed from broker). Following is another quote from the book as to how confident he was in the stock after he bought it:

“All this I had done with the greatest confidence. Now there was nothing to do but sit back and wait until I would begin to reap the harvest of my fool – proof theory.”

Then the stock began to drop, something he never expected to happen. From the book:

“I could not believe it. How could it be? This was the new BIRLUND. This was going to make my fortune. It was no gamble it was a completely detached operation, based on infallible statistics. Still the stock continued to drop.”

The stock kept going down and in the end he decided to sell for a very big loss.

Up until that point he tried many different methods / strategies to trade the market without success. He wanted to give up but decided otherwise.

“Everything had been proved wrong. Gambling, tips, information, research, investigation, whatever method I tried to be successful in the stock market, had not worked out. I was desperate. I did not know what to do. I felt I could not go on. Yet I had to go on. I must save my property. I must find a way to recoup my losses.”

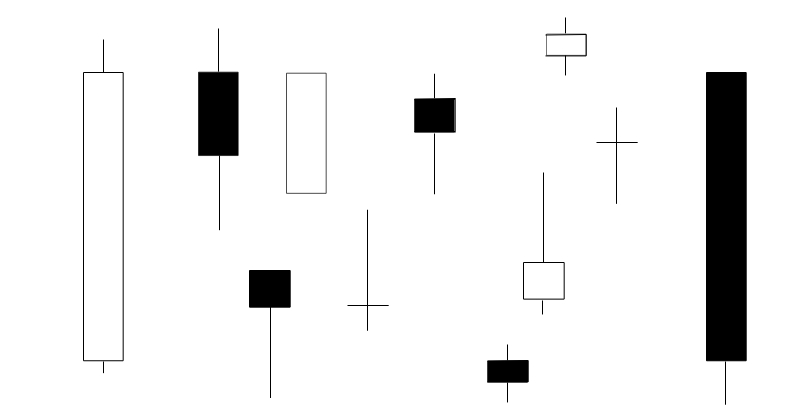

From there he studied some more and started to develop his famous box theory. This same theory brought him much success and many traders’ methods are still based on it today.

Can you relate to the above? I most certainly can. Luckily for me I never traded with borrowed money, but most of the other stuff I was guilty of at some point. That is:

- Searching for the holy grail strategy

- Becoming overly confident when I thought I found it; thinking I can predict the market with certainty

- Then risking too much

- Losing and the devastation from realizing the strategy wasn’t all it promised to be

- Repeat it all over again until I realized there’s no such thing as a holy grail trading strategy

There are many such great lessons in How I Made $2 Million In The Stock Market. It’s not a long read, it’s an easy read and very entertaining. It’s well worth it.

Thanks so much for reading. Hope you and your family are safe and well.

Thanks and Regards,

Trading SOS SOS