This post will give a little more insight into what individual candles tell us. You can read more on the basics of candlesticks here.

Long Bodies:

The size of a candle’s body can give an indication of the current momentum in a market. A long bodied candlestick tells us that the action in a market comes mostly from one side and that momentum is likely to carry on in the direction of such a candle.

Think of the engulfing candle. The second candle, which is the reversal candle, has a longer body than the 1st candle and suggests a reversal of the prevailing trend … building on the momentum of the first candle.

Small Bodies:

Small bodied candles means that price is stalling, that there is indecision, or that there is more or less equilibrium between buyers and sellers. This indecision means that price might reverse.

Where these small bodies form during a price move is important. For example, indecision after a price move at an important support or resistance level will carry more weight than indecision in the middle of some trading range.

These indecision candles come with different names and is discussed next.

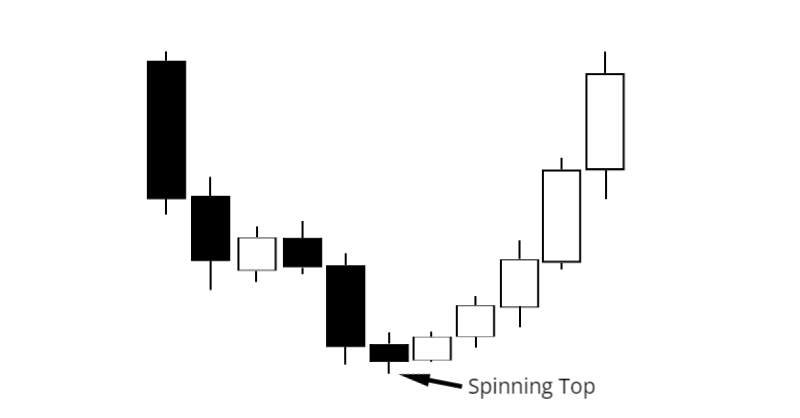

The Spinning Top candlestick pattern have a small body … this means that the open and closing price is close together (color of the body doesn’t matter). Please see picture below:

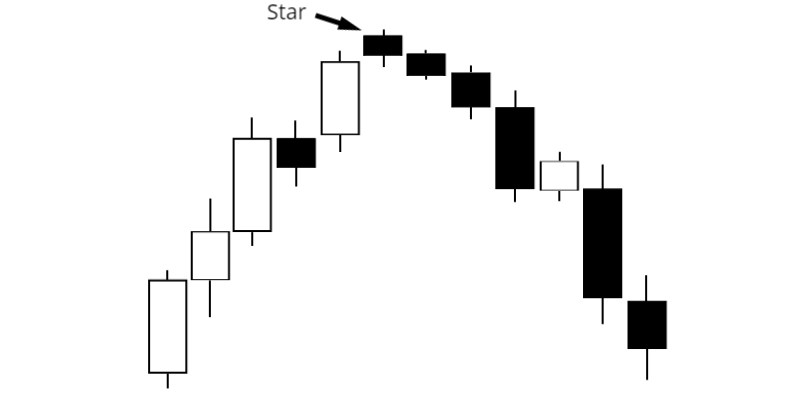

The Star candlestick pattern also have a small body (the color doesn’t matter), but in this case the body of the star gaps away from the body of the preceding candle (their bodies doesn’t touch). See picture below:

Also see Morning / Evening Star and Shooting Star.

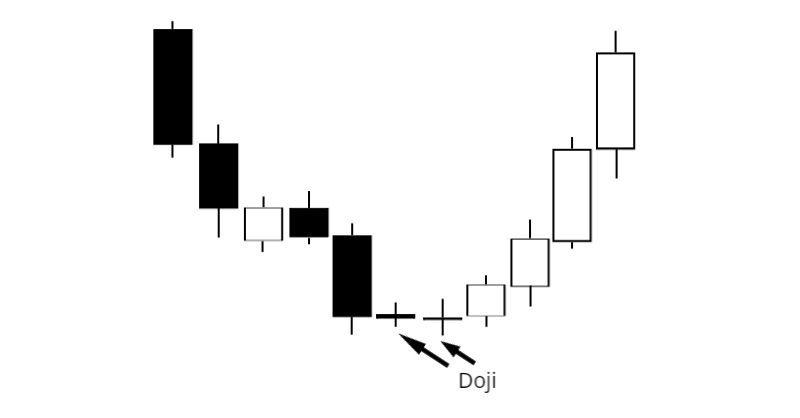

A Doji is a candlestick pattern where the opening and closing price is the same or very close. See picture below.

Wicks / Shadows:

Wicks / Shadows also give information of where price might be headed, like:

- A long upper wick after a price rally suggests a reversal in price (think shooting star).

- A long lower shadow after a price decline suggests a reversal in price (think hammer).

- Long upper and lower wicks of about the same length on a spinning top / indecision candle (see above) increases the possibility of a reversal.

Finally:

Where these different candles form in a market move is very important … market context is important. Also, it is better to wait for confirmation after an indecision candle … this means a can candle to confirm the reversal (think candle number 3 in the morning or evening star pattern.)

Thanks so much for reading. Hope you doing well.

Thanks and Regards,

Trading SOS SOS