In this post I will cover the hammer and hanging man candlestick patterns (also known as pin bars to many traders). They are reversal candles, meaning they indicate that the prevailing market trend may come to an end. Before I go any further, if you are new to candlesticks, you can read about candlestick basics here.

The Hammer and Hanging Man:

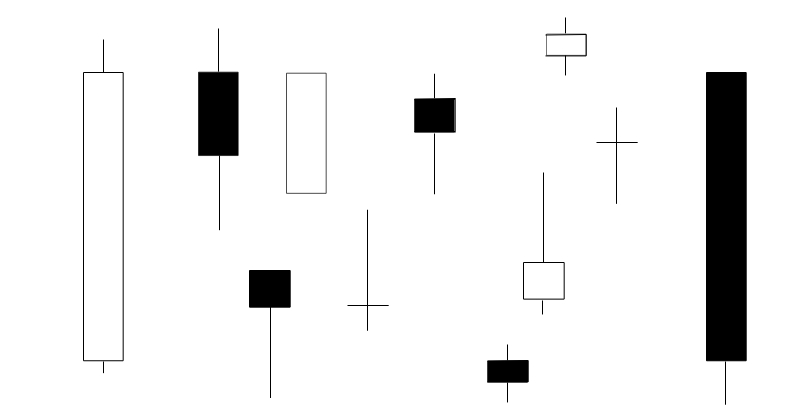

The hammer and hanging man are candlesticks known as umbrella lines. This is because they look like umbrellas in that they have long lower shadows and small real bodies (their color doesn’t matter) at the top of their range with very small or no upper shadows. See picture below:

They look the same, but they can be bullish or bearish depending on where they form in a given market as we will discuss shortly. Firstly, the real body is small, their lower shadows should be at least twice the size of the real body, the color of the body doesn’t matter and they should have no or very small upper shadows.

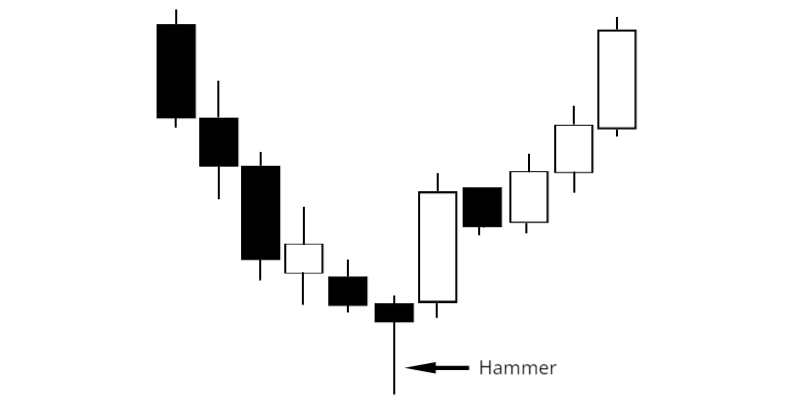

Hammer in Context:

When an umbrella line forms in a downtrend it is referred to as a hammer. Since the hammer is known as a reversal candle, its appearance in a downtrend indicates that the trend might reverse. See picture below:

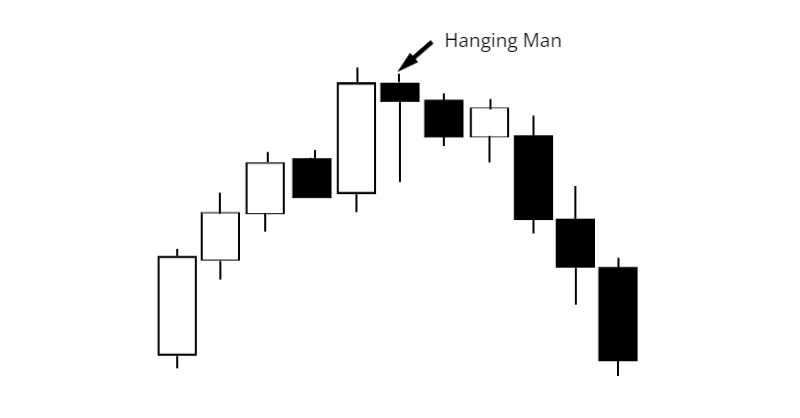

Hanging Man in Context:

When an umbrella line forms in an uptrend it is referred to as a hanging man. Since the hanging man is known as a reversal candle, its appearance in an uptrend indicates that the trend might reverse. The hanging man candle should be confirmed by a bearish candle in order to validate it. See picture below:

Finally:

These candles are more potent the smaller the real bodies and the longer the lower shadows. Also remember that the hanging man needs to be confirmed with a bearish candle, but not the hammer. These patterns can’t be traded blindly whenever they show up on a chart, but should be traded in context of the market structure like trading them from areas of value such as support and resistance for example.

Thank you so much for reading, I hope you enjoyed this post.

Thanks and Regards,

Trading SOS SOS