This post will cover the bullish and bearish harami candlestick pattern. Before I start, if you are new to candlesticks and want an introduction, you can start here.

The Harami Candlestick Pattern:

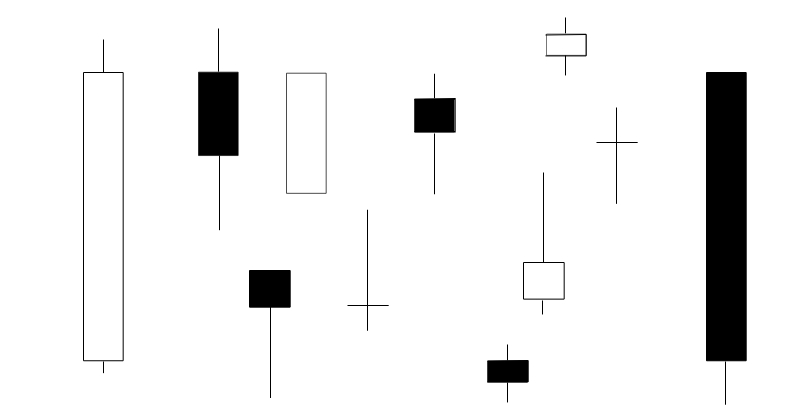

Note: For this post all white candles used in illustrations will mean the candle closed bullish and black candles means it closed bearish.

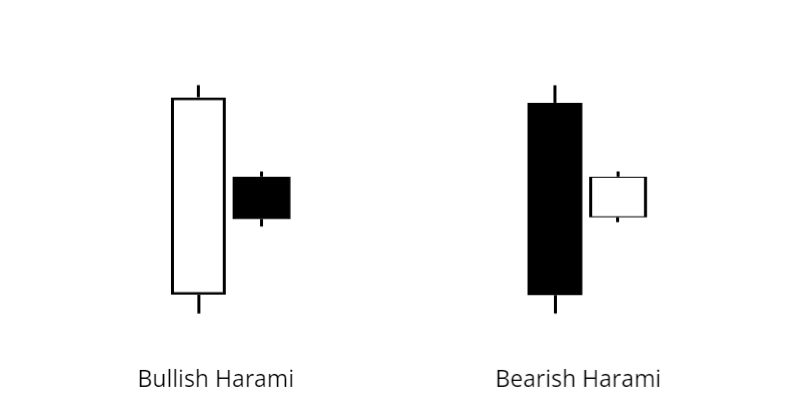

The harami is a reversal pattern that consists of two candles. The first candle has a long real body and the second candle’s body is small . The first candle’s body completely encloses the body of the second candle (its open and close is within the second candle’s body). The color of the second candle doesn’t matter.

See below:

For the second candle, think: spinning top. Also, if the second candle is a doji, its called a harami cross.

The Harami in Context:

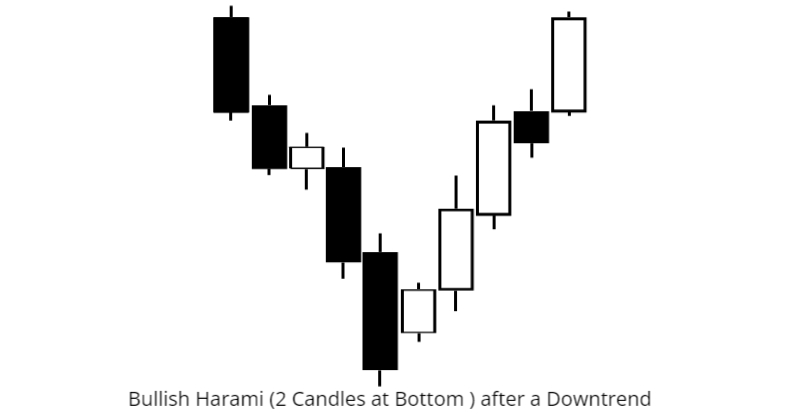

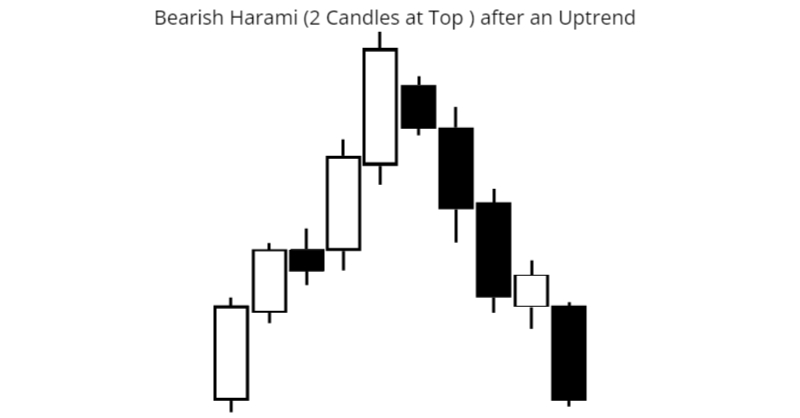

As it is a reversal pattern, it comes after a sustained trend. This means the first candle of a bullish harami pattern will be black as it is part of a downtrend and the first candle of a bearish harami pattern will be white as it forms part of an uptrend.

The second candle’s body is small (spinning top / doji) and is contained completely within the body of the first candle. The small body of the second candle signals indecision, which means price is in balance between buyers and sellers. This means price is likely to reverse. See below:

Bullish Harami after a Downtrend:

Bearish Harami after an Uptrend:

Note: The harami is not as potent as some of the other candlestick patterns such as the engulfing candlestick pattern. So, in my opinion, it’s best to wait for some sort of confirmation after the second candle has completed. For example: wait for the high of the second candle to be taken out before entering in the case of a bullish harami and vice versa for the bearish harami.

Finally:

These patterns can’t be traded blindly whenever they show up on a chart, but should be traded in context of the market. The harami pattern’s odds of working increases the smaller the second candle’s body is. Odds also increase when the engulfing pattern is traded in conjunction with other factors such as support and resistance.

I hope you found this post useful. Thanks so much for reading and good luck with your trading.

Thanks and Regards,

Trading SOS SOS