I can’t decide for you (the trader) on how tight or wide your stops must be, but I can explain how they (tight or wide stops) will affect your trading. And during the process of explaining their differences, I hope to guide towards better stop placement. This is discussed next.

A Quick Reminder:

Before I start, always remember: whether your stops are wide or tight, always have them in place. Getting stopped out is not nice, but it sure is better then getting your account wiped out.

Stops are there to protect us from ourselves and from the market, its there to ensure we can fight (trade) another day. We all wish that all our trades are profitable, but unfortunately that will never be the case… losses will always be there, at least limit them with stops.

Tight and Wide Stops?

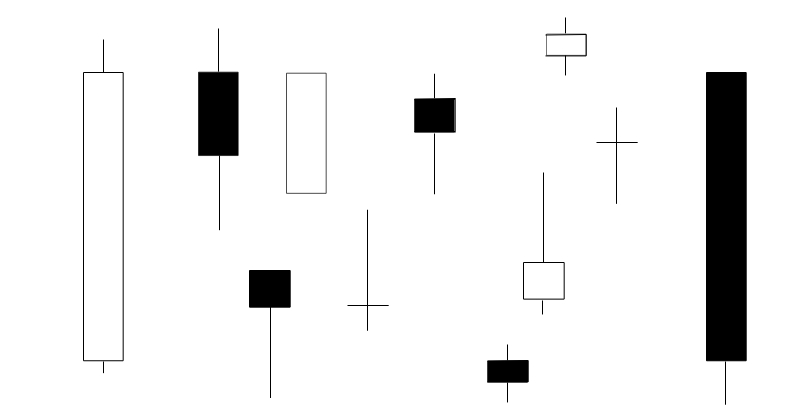

There are many methods to determine where / how a stop can be placed. Common ways are:

- Above / below price levels like support / resistance.

- Above / below indicators such as moving averages.

- Using indicators such as the Stop and Reverse indicator (SAR).

- Above / below candlestick patterns.

- Stops based on a fixed dollar (money) / points / pips amount.

- Stops based on the Average True Range (ATR) indicator.

- Stops based on volatility.

It doesn’t rally matter which method you use. Put simply, a wide stop is when your stop loss is far from your entry point and a tight stop loss is one where your stop is close to your entry.

With that said, we can now move on to how these different stop can influence our trades. Also, keep in mind that in trading there’s always trade-offs.

Tight Stops vs Wide Stops:

All things being equal:

- Tight stops will be stopped out more often than wide stops. Many losses (even if they are small) can be hard / frustrating for some traders to deal with.

- Tight stops will be stopped out faster than wider stops. You will be able to move on quicker to the next trade with tight stops, but with wide stops your capital will be tied up longer (opportunity cost).

- Generally, you’ll be able to risk less with tight stops than with wide stops. Depending on your risk management style, you should be able to put on more trades using tight stops versus wide stops.

- You’ll be able to achieve a higher reward to risk ratio with tight stops compared to wide stops, meaning your account should be able to handle the many small losses.

- Events / news / volatility has less impact on wider stops than tight ones.

- Sitting in drawdown on a trade is not so nice. Tight stops take that pain away quickly, wide stop not so much.

I hope, with the above in mind, you can find your sweet spot on where to place your stops. Both, wide and tight stops, come with positives and negatives.

Finally:

I’m not in any position to tell where / how you are supposed to set your stops. My best advise is to track and review your trades, then adjust your stops if necessary (after a big enough sample size).

You might have to repeat this process a couple of times… that’s okay if you’re committed to trading and you’re in this for the long haul. Also, I encourage to keep researching (get ideas on how to improve) the areas you are struggling with.

Thanks so much for reading, and the best of luck with your trading.

Thanks and Regards,

Trading SOS SOS