Price patterns can in general be put in either the continuation or reversal category. Markets are either trending or range bound (non trending) and it’s this transition between trending, ranging and back to trending markets where continuation and reversal patterns normally come in.

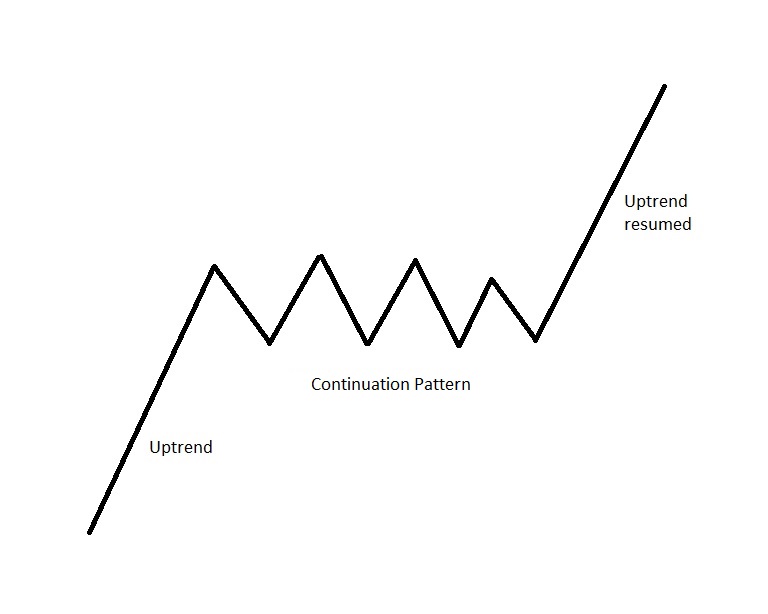

Continuation patterns suggests that on completion of such a pattern, the trend (uptrend / downtrend) that existed before the pattern was formed will be resumed. This kind of pattern represents a consolidation / pause in a market before the trend is resumed. See below an example of how an uptrend is resumed after a consolidation / pause (note that these patterns comes in many forms and sizes) in a market:

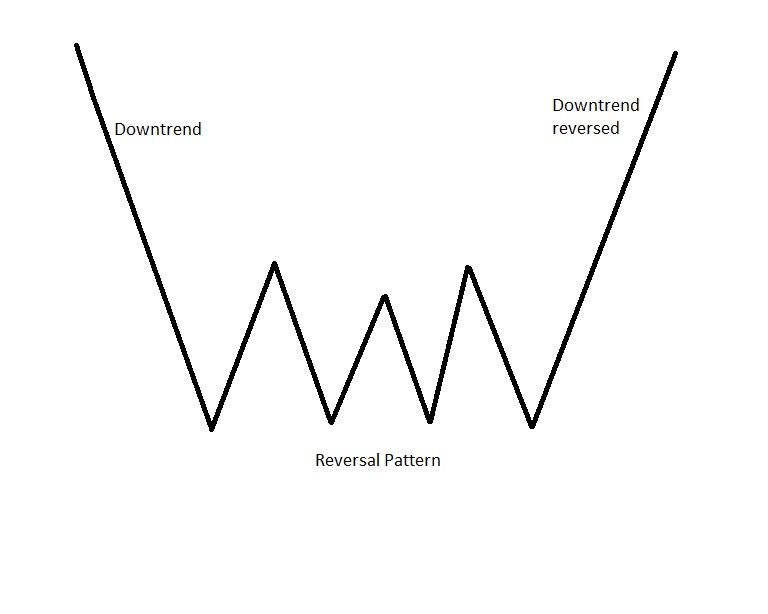

Reversal patterns suggest that on the completion of such a pattern, the trend (uptrend / downtrend) that existed before the pattern was formed will reverse in direction. So you have a trend in place, the pattern forms and on completion of the pattern it is assumed the trend will reverse. See below an example of how a downtrend is reversed (note that these patterns comes in many forms and sizes) in a market:

Some popular patterns are:

- Head and Shoulders

- Double Top and Bottom

- Triple Top and Bottom

- Rectangles

- Cup and Handles

- Flags and Pennants

- Wedges

- Triangles

Some of these patterns like the head and shoulders for example can be of the continuation or reversal type depending on the context of how it is formed and completed in a trend; this you will see in my posts (both future and current) on patterns.

I have to caution that where a pattern forms on a chart is very important (like a trend needs to be in place for a pattern to reverse / continue it). Also, if you learn about a new pattern you must remember that not all of them are successful all the time; they can and do fail. Another caution is that some traders look so hard for certain patterns (because they love the idea of them so much, they just learnt a pattern and is eager to trade it or because of prior success with it) that they actually force themselves to see certain patterns that just isn’t there; patterns should be clear and easy to spot.

Lastly, as you learn more about technical analysis and price patterns you will come to find that trendlines (inclined and horizontal) acting as support and resistance play a big role in their formation and completion.

And that’s all I have to say on the types of price patterns!

Thanks for reading.

Regards,

Trading SOS SOS